The emerging 5G market has become a battlefield for nations to seek global influence and enhance domestic power. While the U.S. and authoritarian regimes have different approaches and goals on the development of 5G telecommunications technology and infrastructure, some in the United States are calling for additional steps to limit the reach of foreign-owned carriers.

In a speech last week hosted by the Center for Strategic and International Studies, Jessica Rosenworcel, chair of the U.S. Federal Communications Commission, said that the agency may reassess its process for authorizing foreign telecom carriers to operate in the U.S. market if there is an evolving national and cybersecurity concern.

Rosenworcel said that the commission’s previous “one-and-done” approach to licensing around telecom services poses a security risk and should be re-evaluated. She argued in favor of the agency taking a stricter oversight role, saying “there is currently nothing in our rules that requires the FCC or national security agencies to generally reassess a foreign carrier’s authorization to provide service. This is in stark contrast to most other authorizations granted by the FCC that must be considered on a periodic basis,” she said.

She also made it clear that she intends to press her fellow commissioners to alter and bolster those rules in the near future.

“Stay tuned, because I will soon share with my colleagues a rule-making to explore this concept,” she added.

Underscoring the continued concerns of U.S. policymakers, a Jan. 20 report by CSIS concluded that the U.S. and other allies should leverage their free-market values so that the innovation-oriented ideals of democracies prevail over the PRC’s control-oriented authoritarianism and government-dominated industrial policy.

“Will the future be one of freedom and innovation or surveillance and control? Given 5G’s potential to tackle key contemporary challenges, it is imperative that the United States continue to lead on 5G in the competitive global marketplace,” the report noted.

5G's cybersecurity and political implications

While Rosenworcel said the FCC’s potential move is out of cybersecurity consideration, it is also intertwined and backed up by geopolitical and economic factors, said Taylor Grossman, senior researcher at the Center for Security Studies at ETH Zurich.

“The U.S. has concerns about inherent security issues associated with foreign carriers and services, such as surveillance, backdoors, and potential for sabotage. But it also worries about the economic dependency on other nations with distinct foreign policy goals that do not align with the U.S.,” Grossman told S.C. Media in an interview.

Despite former Google CEO Eric Schmidt writing in a Feb. 16, 2022, Wall Street Journal op-ed that the U.S. is “far behind in almost every dimension of 5G while other nations — including China — race ahead,” Rosenworcel applauded the progress the U.S. has recently made in 5G network development.

Citing the next secretary general of the International Telecommunications Union’s recent election of American Doreen Bogdan-Martin over Russia's Rominee Rashid Ismailove, Rosenworcel said it is a “massive victory” for the U.S. in leading next-generation technologies.

“Let’s be honest: the United States and authoritarian regimes have different views on how to use 5G technology. The vision that succeeds in a global forum like ITU matters. It will inform how networks are deployed and evolve around the world,” Rosenworcel said.

ITU is the United Nation's agency for information and communication technologies, driving innovation in the field together with 193 member states, including China and Russia. Like many UN organizations, despite its internationalist ethos and mandate, the agency involves political factors in which different parties are seeking to foster their ideology and technology focus through the election.

Besides the success in the ITU election, the investment by the U.S. in rolling out multiple and regional 5G networks over the past five years has helped lay the groundwork for the country’s network development, according to the Jan. 20 CSIS paper “The Strategic Imperative of U.S. Leadership in Next-General Network” that Rosenworcel referred to in her speech.

“On a per capita basis, U.S. broadband investment is many times greater than that of other countries, including its allies. Taken together, the U.S. wireless industry has invested over $130 billion in private capital over the past five years, and in 2020 the country accounted for 18 percent of all global wireless investment despite only representing 4.5 percent of the world’s population,” wrote Clete Johnson, the paper’s author and non-resident senior fellow at CSIS.

U.S. policy may be blunting the progress of Chinese telecoms

Meanwhile, there is some evidence that a concerted effort by U.S. policymakers to slow down once-dominant Chinese firms in the telecommunications space and dissuade allies from relying on equipment from companies like Huawei is having an effect.

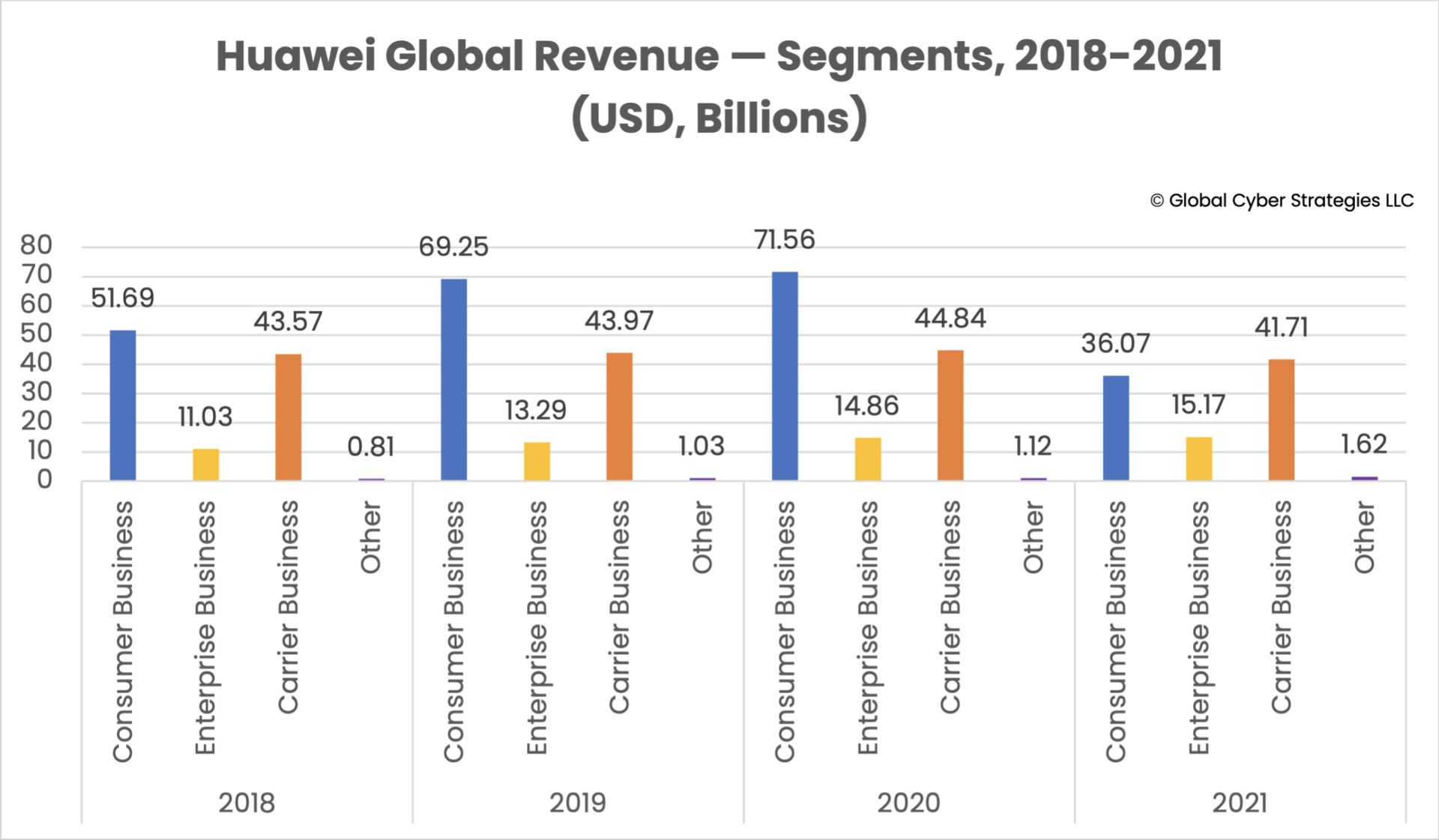

According to new research this week from cybersecurity policy researcher Justin Sherman, after five straight years of increased revenues, Chinese telecom giant Huawei has seen its coffers stagnate and eventually decline over the past three years as business declined across Europe, the Middle East, Africa and the Asia-Pacific.

That decline broadly coincides with a major push by successive U.S. administrations over the past five years to impose sanctions on Chinese-owned telecommunications companies, including Huawei, to restrict their ability to obtain high-value equipment and parts, rip out and replace their tech within U.S. telecommunications infrastructure and press international allies and partners to move away from reliance on Chinese-owned firms.

“Despite the Trump administration’s many difficulties in convincing other countries to ban Huawei 5G equipment — including because of the administration’s botched diplomatic messaging campaign — many countries began shifting towards the end of the administration to banning Huawei from their markets or effectively sidelining Huawei, even without an official ban," Sherman wrote.

Oddly, Sherman’s data shows that the U.S. is one of a few markets, along with China, where Huawei actually experienced some small growth between 2018-2021, though this, too, has appeared drop off since 2021. Further, while Huawei’s revenues have taken a tumble, dropping nearly 30% since 2020, the company’s net profits have more than doubled over that same time as it has been able to leverage other business verticals.

To build on the momentum, the U.S. should learn from Europe’s failure in 3G, 4G, and 5G due to the fragmented EU regulatory and political structure and continue supporting free-market-based innovation, a nationwide regulatory framework, and pro-investment policies, Johnson noted.

“Will the future be one of freedom and innovation or surveillance and control? Given 5G’s potential to tackle contemporary challenges, it is imperative that the United States continue to lead on 5G in the competitive global marketplace,” he said.

Grossman, though, worried that the country is going “too far” into the U.S.-centered approach, especially when it comes to adding other countries’ carriers to the sanction list out of security considerations.

“The security risks of foreign products and services shouldn’t be underestimated. But I think it’s really important to optimize and balance real security risk and economic concerns,” she said.