Cyberinsurance premiums were observed by brokerage firm Howden to have declined by nearly 15% from peak levels in 2022 and while such a decrease was attributed to improved cybersecurity, experts said that the lower rates were more likely to be a corrective measure from insurers as part of a cyclical market, SecurityWeek reports.

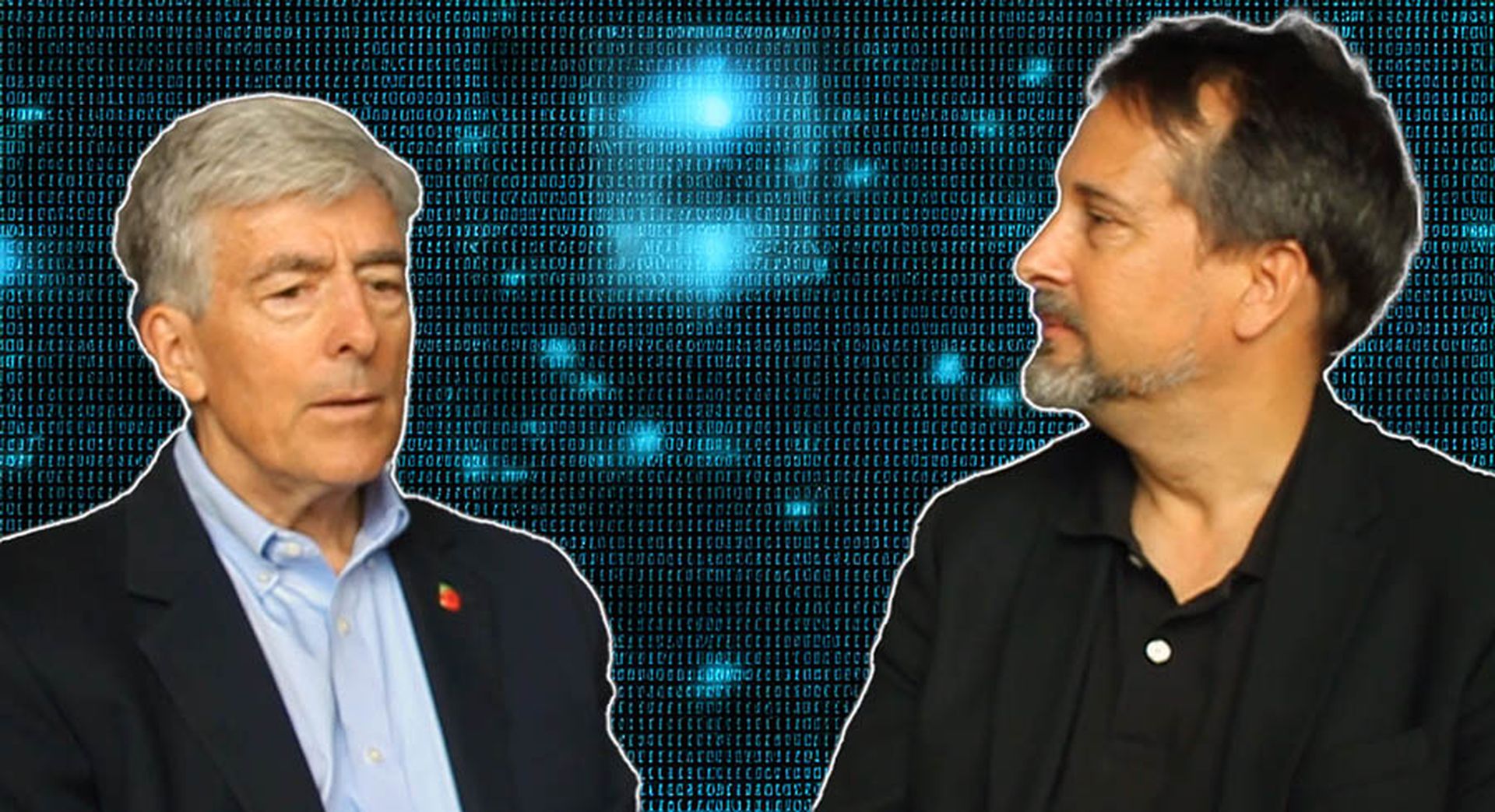

"What we are likely seeing with lower premiums is a consequence of several factors: the insurance market's cyclical nature, now with more capacity in the market, combined with self-insurance retentions covering many of the frequency losses," said Fenix24 Managing Director Marko Polunic.

Similar statements regarding the rating cycles in insurance have been shared by DeNexus Head of Risk Solutions George Mawdsley, who believes that premiums are likely to return to an upward trajectory soon.

"What makes cyber unique is that there is material uncertainty around how big the 'Big Storms' can get, which means capital allocators will make conservative assumptions on max downside or will not invest. Given the strong growth projections (demand) for the cyberinsurance market, we expect this dynamic to drive up prices over the long term," Mawdsley said.