COMMENTARY: What do World War II, the proposed acquisition of U.S. Steel, and China have in common?

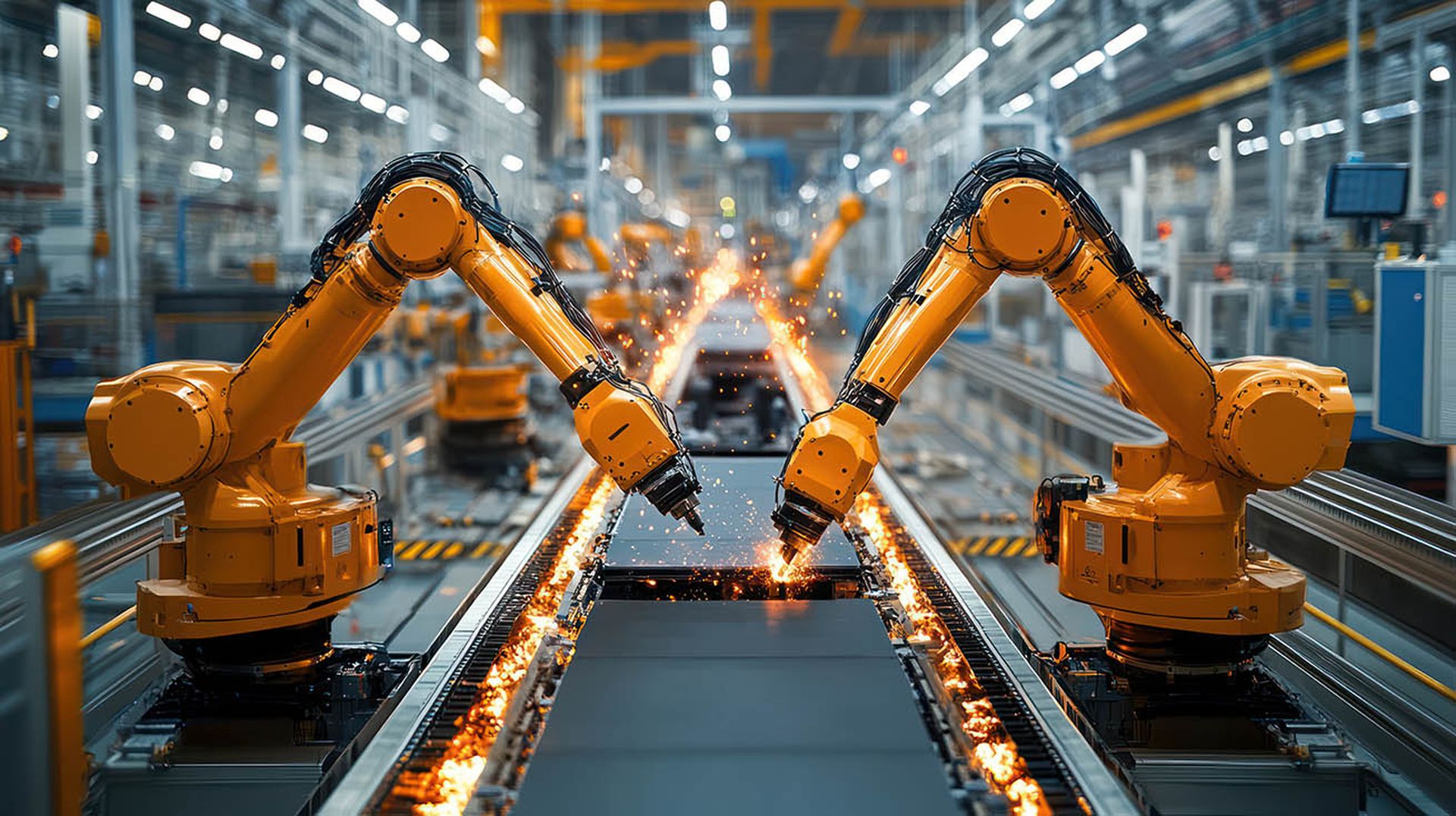

They are all cautionary tales about how all wars, past, present, and future, are won with manufacturing. As the world navigates through the complex web of global trade and geopolitical tensions, the manufacturing sector stands at the forefront of a new battleground between the United States and China.

The implications of China's dominance in shipbuilding, the increased cyberattacks against the sector, and the strategic implications of the proposed Nippon Steel acquisition of U.S. Steel could signal a future military confrontation with China.

Here's why: During World War II, America's industrial prowess was key to its victory, transforming the nation into the "Arsenal of Democracy." Today’s scenario, where manufacturing capabilities are increasingly outsourced or are under foreign control, contrasts sharply with this historic might. The U.S. once led in shipbuilding, but now, the narrative has shifted to concerns over losing ground in production, technological innovation, and strategic autonomy.

This shift presents a precursor to how industrial capacity will play a role in future conflicts, where economic warfare could precede or parallel military engagements and impact more than steel. It includes chemical and petrochemicals, and the machinery and equipment needed for war.

[SC Media Perspectives columns are written by a trusted community of SC Media cybersecurity subject matter experts. Read more Perspectives here.]

When it's time to build ships, tanks, and planes, a country that doesn't control the means of production will lose its strategic advantage for decades.

Manufacturing in the crosshairs

According to a recent report by Ontinue, the manufacturing industry has seen increased cyberattacks. In the first half of the year, 41% of incidents were in the manufacturing industry, representing a 105% increase from 2023. What could account for this increase?

Other vulnerable sectors, like IT, have had to fight a long, hard battle to improve defenses and harden systems. Cyberattacks are like burglars—the easier the target, the better. According to the numbers, manufacturing has become that easier target.

The increase in attacks could also be part of a broader strategy to degrade the production of equipment and munitions needed to establish a wartime footing. Without manufacturing, our adversaries can bring us to our knees. A military strike using kinetic weapons on a manufacturing facility would be an act of war. What better way to avoid direct confrontation than by using cyberattacks to bring the sector to a grinding halt right before hostilities break out?

China's shipbuilding supremacy

China's ascent to the pinnacle of the global shipbuilding industry is not merely a commercial achievement, but a strategic move that underscores its broader geopolitical ambitions. With shipyards covering more than 60% of the global order book, China has outpaced traditional leaders like South Korea and set the stage for a maritime domain where its influence could dictate terms. This dominance has been fueled by state subsidies, technological innovation, and a clear policy of military-civil fusion, where commercial shipbuilding capabilities directly enhance naval power.

The U.S. has taken note, with recent actions by the Biden administration signaling a recognition of this threat. The U.S. aims to counteract it through tariffs and investigations into China's trade practices.

The proposed Nippon Steel acquisition of U.S. Steel

The proposed acquisition of U.S. Steel by Nippon Steel, which has been postponed until after the Presidential election in November, has stirred a hornet's nest in American industrial policy circles. If realized, this move would see one of America's iconic steel companies, vital for national security and infrastructure, under foreign ownership.

While on the surface, this might seem like a straightforward business transaction, it resonates with deeper concerns about national security, economic sovereignty, and the strategic importance of steel in manufacturing, especially in shipbuilding. Critics argue that this could lead to a dependency on foreign steel, potentially weakening America's industrial base, reminiscent of the self-reliance that was a cornerstone of its WWII industrial power.

The deal has sparked opposition from both the White House and lawmakers across party lines in the U.S., citing concerns over national security, supply chains, and the impact on American workers. President Biden is reportedly prepared to block the acquisition, reflecting the deal's significant political resistance.

Potential for military conflict

The intertwining of economic prowess with military strategy is nothing new. Still, the scale and nature of today's global economy add layers of complexity. China's shipbuilding capacity, combined with its strategic interests in the South China Sea and beyond, hints at a broader ambition that could lead to military confrontations. The U.S., recognizing the strategic importance of maintaining a competitive edge in manufacturing, especially in critical sectors like steel and shipbuilding, has not just responded with economic measures, but also has reevaluated its military strategies in the Indo-Pacific region.

Discussions range from the technological espionage risks posed by Chinese equipment in U.S. ports to the broader implications of China's manufacturing dominance on global security. Continued reporting highlights a public increasingly attuned to the strategic implications of economic dependencies, echoing fears of a scenario where economic warfare could escalate into military conflict.

The interplay between China's shipbuilding lead, the strategic acquisition of U.S. Steel, and the historical lessons from WWII's industrial might paint a complex picture of where global manufacturing might be headed. While not an immediate call to arms, these developments signal a shift towards a more contested industrial landscape, where economic strategies are as critical as military ones.

Territorial disputes and the connections of global trade and manufacturing supremacy create the potential for conflict. As nations like the U.S. fortify their industrial policies, the world watches, aware that battles over steel, ships, and cyberspace might precede the next great conflict. Strategic industries like manufacturing, which make modern warfare possible and are under constant threat of cyberattacks, are most at risk.

Morgan Wright, chief security advisor, SentinelOne

SC Media Perspectives columns are written by a trusted community of SC Media cybersecurity subject matter experts. Each contribution has a goal of bringing a unique voice to important cybersecurity topics. Content strives to be of the highest quality, objective and non-commercial.