Imagine a day in the near future when you go to a bank to apply for a loan. Instead of providing a driver's license, passport or birth certificate to verify your identity, and then filling out forms providing your date of birth, street address, email address, Social Security number and employment status, you simply tap your phone and display a QR code that the bank's loan office scans to get all that information.

That QR code will be generated by your digital wallet, an upgraded version of currently used smartphone payment apps such as Apple Wallet or Google Pay. The digital wallet will be able to electronically access your bank accounts and credit cards and also hold digital versions of government IDs, personal information about you and even tickets for plane flights and events.

Not only that, but the wallet will also let you take back control of your personal information from websites and social-media services. Instead of those services holding your personal data — and risking it being stolen in data breaches — you will keep it safe on your smartphone, and the wallet app will verify your identity to these websites without giving them more information than they need, all without the need to type in a password.

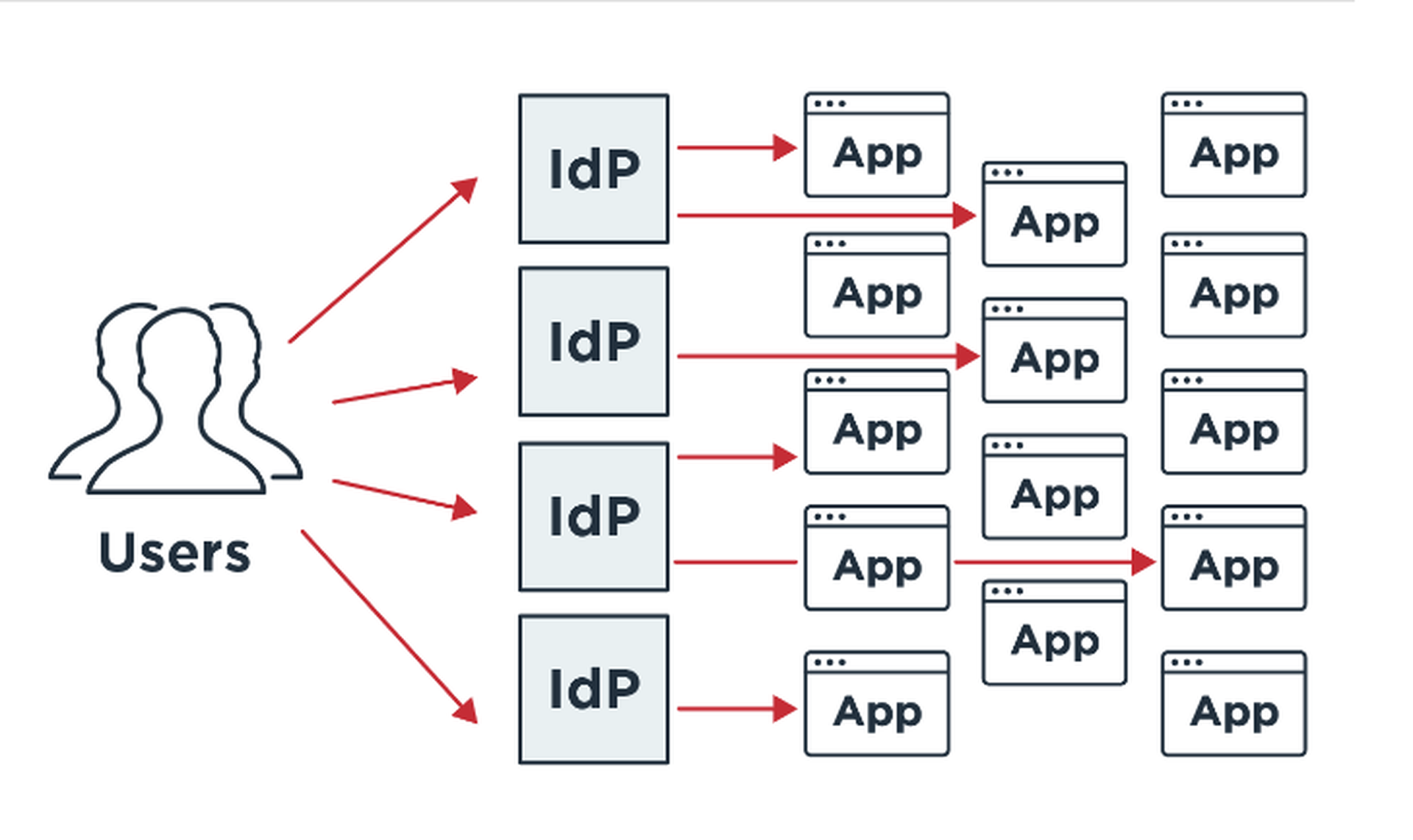

"We are used to organizations holding our identity data — Google, Facebook, etc. — and everyone needs your identity before they give you access," said Vinny Sagar, a senior solutions architect with Ping Identity. "If you have 1,000 identity providers and 1,000 service providers, that's 1,000 x 1,000 connections to maintain and manage. It's not scalable."

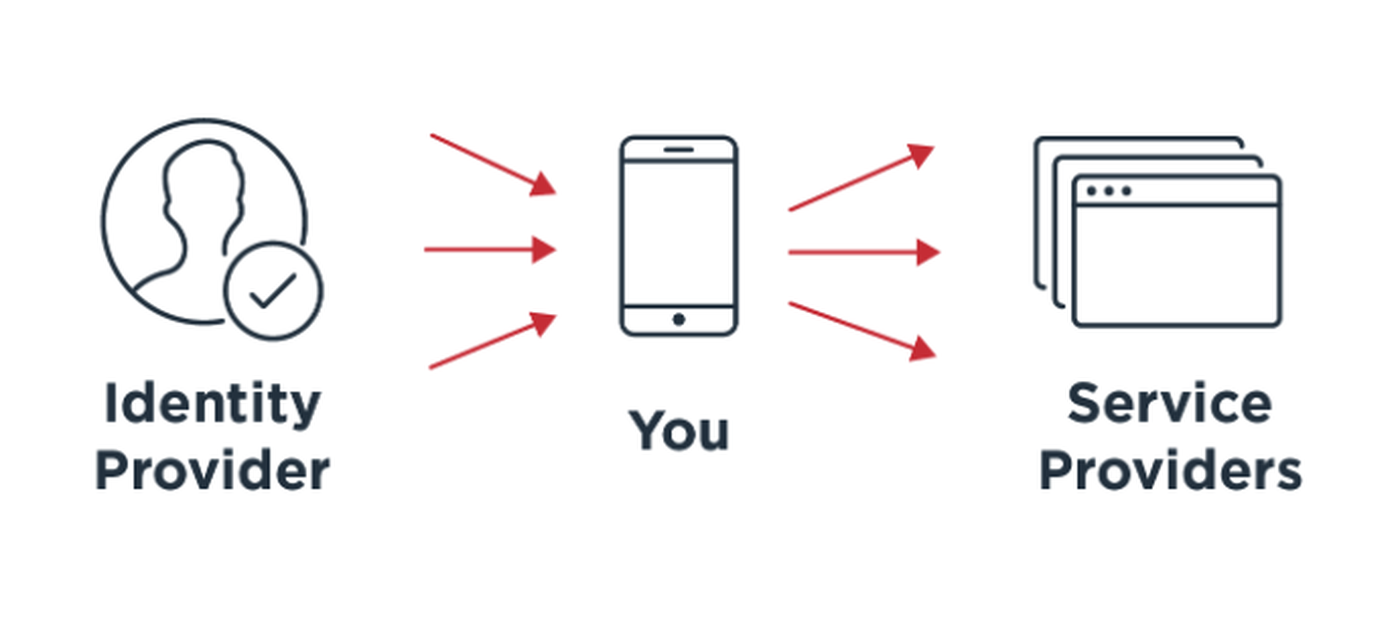

However, said Sagar, "with your phone or something in your phone acting as a wallet storing a verifiable record of yourself it becomes much easier. The consumer is in control without having a backend connection to maintain."

Europe leads the way

Several countries already use physical identity cards with embedded chips that hold personal data, with Estonia being perhaps the best-known example. But the European Union is taking this a step further with the European Digital Identity framework, which by 2024 aims to make available a smartphone-based electronic ID system that will let EU members travel, shop, bank and use government services.

"Every time an app or website asks us to create a new digital identity or to easily log on via a big platform, we have no idea what happens to our data in reality," said European Commission President Ursula von der Leyen in 2020.

The European Digital ID, or EDI, will be "one that we trust and that any citizen can use anywhere in Europe to do anything from paying your taxes to renting a bicycle," von der Leyen added.

The European Digital ID will be designed to give service providers only as much information as they need to carry out the service. There should be no more oversharing of personal data.

"The EDI will eliminate revealing personal information not relevant to any specific task or transaction, such as opening a bank account, filing taxes, proving age, renting a car or checking into a hotel," noted Ping Identity's Sagar.

The EDI will not be obligatory across Europe. While some member states currently mandate that citizens of adult age carry a national ID card, others make it optional, and a few are like the United States or Canada in that they have no national ID card at all.

Trouble crossing the pond

So will such a digital ID become widely accepted in North America? Early signs are not promising.

Apple has been trying to get iPhone users in the United States to use Apple Wallet as a digital ID, but the uptake among government agencies is slow. So far, only Arizona and Maryland allow adding state driver's licenses to Apple Wallet, although a few other states are in the process of working out the details. (In May 2022, Google said a rival Google Wallet app would become available later in the year.)

Apple itself doesn't disclose how many iPhone owners actively use Apple Wallet, but a late 2021 PYMNTS.com study of Apple Pay hints that "the use of Apple's digital wallet is thus far failing to catch on as so many of its other connected services have."

While Apple Pay is the leading smartphone-payment platform in the U.S., PYMNTS.com noted, "consumers are using mobile wallets for just 4.5% of their in-person shopping in 2021, 26% less often than in 2019 — meaning Apple has been growing its share of a shrinking market.”

A way forward

A possible solution might be wallet apps like Ping Identity's ShoCard ID which, unlike Apple Wallet, is also available for Android phones. ShoCard lets you scan in your driver's license, passport, vaccination records, credit cards and other documents, although it's not clear how many states will accept the digital version of the driver's license if you get pulled over by a traffic cop.

Such wallet apps make it easy to share personal information, like the still-theoretical European Digital ID. Entities that need to verify your information can get it by scanning a QR code or via an email or SMS message sent from your phone.

As with the European Digital ID, the information retained by such wallet apps is only on your smartphone, and you can select how much data verifying identities get.

It may be some time before these next-generation wallet apps catch up with Apple (or Google) Wallet, and even then it's not clear how quickly the digital wallet will catch on.

But as a way of securely providing personal information, they indeed hold promise.